Choosing the Right Bank Statement Data Entry Services Provider: A Complete Guide

September 15, 2025

September 15, 2025

Managing financial data accurately is the backbone of any successful business. From reconciling accounts to preparing financial reports, the quality of your data directly impacts decision-making. One critical aspect of this process is bank statement data entry—the systematic entry, verification, and organization of bank transaction records into digital systems.

For organizations handling a large volume of financial data, outsourcing to a professional bank statement data entry services provider ensures accuracy, efficiency, and compliance. In this blog, we’ll explore why businesses rely on these services, what to look for in a provider, and how the right partner can streamline your financial operations.

What is Bank Statement Data Entry?

Bank statement data entry involves extracting transaction details from physical or digital bank statements and entering them into accounting software, spreadsheets, or ERP systems. This process is vital for:

Account reconciliation – matching statements with internal records.

Expense tracking – monitoring and categorizing business spending.

Financial reporting – generating reliable balance sheets and income statements.

Fraud detection – spotting unusual or unauthorized transactions.

A reliable bank statement data entry services provider ensures that these tasks are completed with maximum precision, saving businesses time and preventing costly financial errors.

Why Businesses Need Professional Bank Statement Data Entry Services

1. Accuracy in Financial Records

Even a small data entry mistake in bank transactions can disrupt financial statements and cause compliance issues. Outsourcing ensures professional teams double-check and validate every entry.

2. Time and Cost Savings

Manually entering large volumes of bank transactions can be tedious and time-consuming for in-house staff. By outsourcing, businesses reduce overhead costs while freeing up employees to focus on core operations.

3. Compliance and Security

Bank statement data involves sensitive financial details. A trusted provider follows strict data security measures, confidentiality agreements, and compliance with standards like GDPR or ISO certifications.

4. Scalability and Flexibility

Whether your business deals with a few monthly statements or thousands, a professional provider can scale services based on demand, ensuring quick turnaround times.

5. Integration with Accounting Software

Top providers are skilled in working with accounting platforms such as QuickBooks, Xero, Tally, Zoho Books, or custom ERP systems, ensuring seamless data integration.

Key Services Offered by a Bank Statement Data Entry Services Provider

Data Capture and Digitization

Converting paper-based or scanned bank statements into structured digital formats.

Data Validation and Error Checking

Ensuring that all entries match official bank records, removing duplication or discrepancies.

Categorization of Transactions

Classifying transactions under relevant expense or income categories for easy reporting.

Reconciliation Support

Cross-verifying bank statements with internal ledgers to maintain balanced books.

Secure Storage and Retrieval

Providing businesses with a centralized, easily accessible database for financial records.

Industries That Benefit from Bank Statement Data Entry Services

Banking & Financial Institutions – For loan processing, compliance, and auditing.

Insurance Companies – For claim verifications and payout reconciliations.

Healthcare Providers – For handling patient billing and payment reconciliation.

E-commerce & Retail – For processing high transaction volumes efficiently.

Small & Medium Enterprises (SMEs) – For cost-effective bookkeeping and reporting.

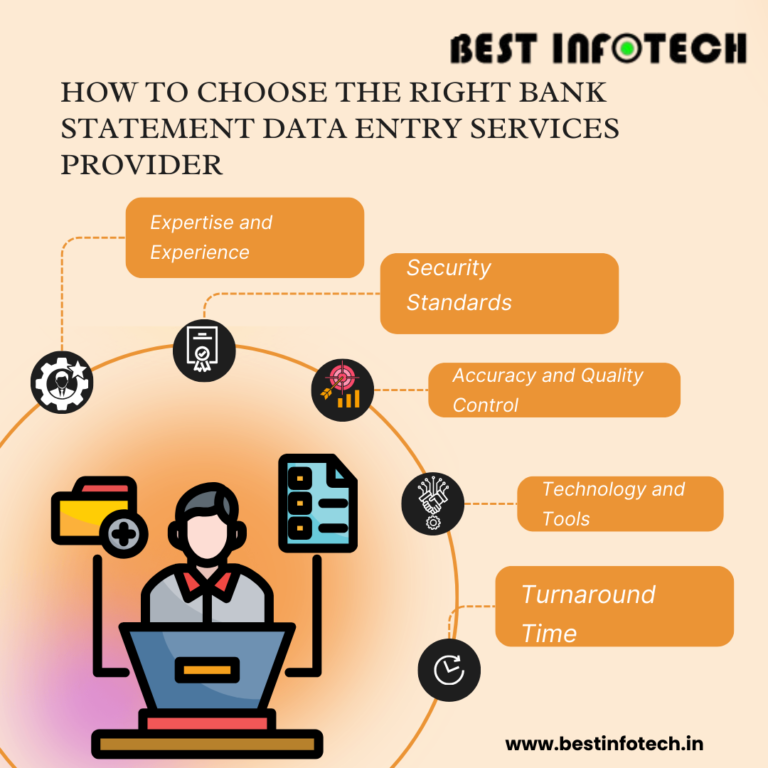

How to Choose the Right Bank Statement Data Entry Services Provider

Selecting the right provider can make a big difference in data accuracy and business efficiency. Here’s what you should evaluate:

1. Expertise and Experience

Choose a provider with proven experience in handling large volumes of financial data and familiarity with your industry.

2. Security Standards

Ensure they follow encryption protocols, NDA policies, and compliance with data protection laws to safeguard your financial information.

3. Accuracy and Quality Control

Look for multi-level quality checks and error-detection processes.

4. Technology and Tools

Providers using OCR (Optical Character Recognition), AI-driven validation, and modern accounting integrations can deliver faster and more reliable results.

5. Turnaround Time

Timely processing is critical for financial reporting. A dependable provider should guarantee quick delivery without compromising accuracy.

6. Cost-Effectiveness

Compare pricing models—per document, per transaction, or monthly contracts—to find a solution that aligns with your budget.

Benefits of Partnering with Best Infotech – Your Trusted Bank Statement Data Entry Services Provider

At Best Infotech, we specialize in providing accurate, secure, and scalable bank statement data entry services for businesses across industries. Our team of experts ensures that every transaction is carefully recorded, validated, and integrated into your financial system.

High Accuracy Rates – Multi-level data verification processes.

Data Security – Confidential handling of sensitive financial information.

Customized Solutions – Services tailored to business needs and volume.

Affordable Pricing – Flexible plans for small businesses and enterprises.

Quick Turnaround – Timely delivery to meet your reporting deadlines.

Final Thoughts

Bank statement data entry may seem like a back-office task, but its accuracy directly affects your financial health and business growth. Partnering with the right bank statement data entry services provider ensures precision, security, and cost savings—allowing you to focus on strategic decision-making while experts handle your financial records.

Looking for a trusted bank statement data entry services provider in Chennai and across India?

Contact Best Infotech today to get reliable, secure, and affordable solutions tailored to your business needs.

Contact us today